rolex vs rental property | index funds vs rental properties rolex vs rental property A new study from online retailer Bob's Watches found that Rolexes may be an even better investment than stocks, real estate or gold. Our international health insurance plans help protect expat individuals, professionals, students and families as they work and live abroad. Explore our plans and choose the .

0 · share market vs rental property

1 · rolexes in real estate

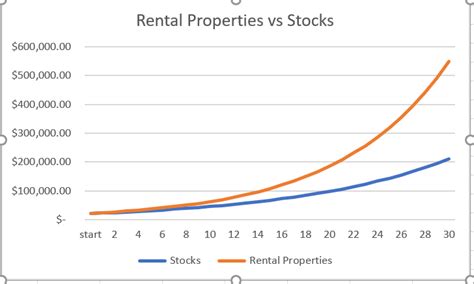

2 · rental property vs stock market

3 · investing in rental property

4 · index funds vs rental properties

5 · Rolex vs stock market

6 · Rolex investments

$18K+

A new study from online retailer Bob's Watches found that Rolexes may be an even better investment than stocks, real estate or gold.

nike dunks replicas

First introduced in 1953, the Rolex Submariner Date continues to be a . Rolex vs Rental Property. The Goddamn Fools. Play. This week we discuss . Explore the pros and cons of owning a rental property vs. investing in the stock market. Discover why property is a popular investment and the psychological benefits it offers.

share market vs rental property

Key Takeaways. Rental properties are worth the investment if they are planned for and handled correctly. The drawbacks of having rental properties include a lack of liquidity, the cost of. Key Points. Rental property can create additional income streams, both now and well into retirement. Owning rental property creates the opportunity of appreciation as well as tax benefits. By.

A key part of deciding whether to invest in rental property is determining how much money you have to spend—and whether you’ll pay in cash or take out a mortgage. The main difference between investing in real estate and stocks is that investing in real estate involves buying properties and renting them out or investing in REITs (real estate investment. Key Takeaways. Determining the cost of and the return on an investment property are just as important as figuring out its value. Investors can use the sales comparison approach, the capital asset. Here's a quick look at ROI, how to calculate it for your rental property, and why it's important that you know a property's ROI before you make a real estate purchase.

rolexes in real estate

rental property vs stock market

A new study from online retailer Bob's Watches found that Rolexes may be an even better investment than stocks, real estate or gold.

A primary difference between index funds and real estate is rooted in monthly cash flow. Investing in real estate has the potential to generate more stable cash flow on average. Speaking.

Rolex vs Rental Property. The Goddamn Fools. Play. This week we discuss Wilder/Fury 2 (2:25), Harvey Weinstein convicted of rape (11:30), Coronavirus scaring everyone (21:18), Kobe Bryant's memorial (39:12), Rolex vs Rental Property (53:58), Tony Romo's new CBS deal, TV Shows, new music, and more.

Explore the pros and cons of owning a rental property vs. investing in the stock market. Discover why property is a popular investment and the psychological benefits it offers. Key Takeaways. Rental properties are worth the investment if they are planned for and handled correctly. The drawbacks of having rental properties include a lack of liquidity, the cost of. Key Points. Rental property can create additional income streams, both now and well into retirement. Owning rental property creates the opportunity of appreciation as well as tax benefits. By. A key part of deciding whether to invest in rental property is determining how much money you have to spend—and whether you’ll pay in cash or take out a mortgage.

The main difference between investing in real estate and stocks is that investing in real estate involves buying properties and renting them out or investing in REITs (real estate investment. Key Takeaways. Determining the cost of and the return on an investment property are just as important as figuring out its value. Investors can use the sales comparison approach, the capital asset.

Here's a quick look at ROI, how to calculate it for your rental property, and why it's important that you know a property's ROI before you make a real estate purchase. A new study from online retailer Bob's Watches found that Rolexes may be an even better investment than stocks, real estate or gold.

A primary difference between index funds and real estate is rooted in monthly cash flow. Investing in real estate has the potential to generate more stable cash flow on average. Speaking. Rolex vs Rental Property. The Goddamn Fools. Play. This week we discuss Wilder/Fury 2 (2:25), Harvey Weinstein convicted of rape (11:30), Coronavirus scaring everyone (21:18), Kobe Bryant's memorial (39:12), Rolex vs Rental Property (53:58), Tony Romo's new CBS deal, TV Shows, new music, and more. Explore the pros and cons of owning a rental property vs. investing in the stock market. Discover why property is a popular investment and the psychological benefits it offers.

Key Takeaways. Rental properties are worth the investment if they are planned for and handled correctly. The drawbacks of having rental properties include a lack of liquidity, the cost of.

investing in rental property

Key Points. Rental property can create additional income streams, both now and well into retirement. Owning rental property creates the opportunity of appreciation as well as tax benefits. By. A key part of deciding whether to invest in rental property is determining how much money you have to spend—and whether you’ll pay in cash or take out a mortgage. The main difference between investing in real estate and stocks is that investing in real estate involves buying properties and renting them out or investing in REITs (real estate investment. Key Takeaways. Determining the cost of and the return on an investment property are just as important as figuring out its value. Investors can use the sales comparison approach, the capital asset.

index funds vs rental properties

$6,500.00

rolex vs rental property|index funds vs rental properties